Income and Expense Categorisation

Streamline your lending processes and make more informed decisions at every step of the credit lifecycle

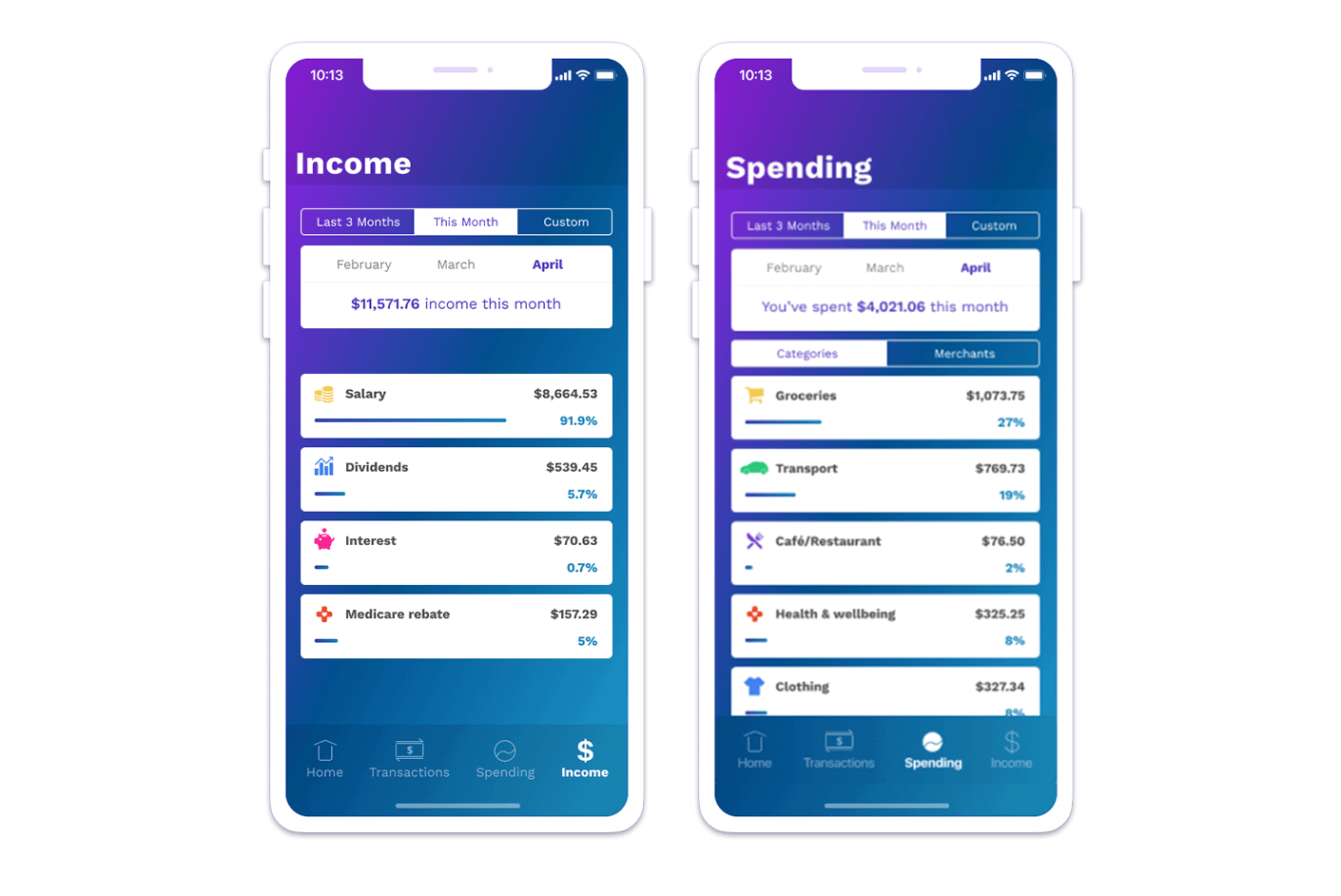

Customers expect better, quicker and more personalised experiences across the credit lifecycle. To help meet these expectations, lenders require an accurate view of their customers’ finances, with an understanding of what they earn, spend, save and what they can afford to repay when they borrow

Using our super-fast API you can automate the identification of income and expenses in your own data to streamline your lending processes and make more informed decisions at every step of the credit lifecycle.

Distinguish between income transactions and identify the employer behind salary payments.

Categorise expenditure with up to 300 customisable sub categories for refined spend analytics, including the ability to analyse discretionary vs non-discretionary spend.

Our tags are an additional field separate from our categories. They enable you to highlight key transactions of interest or concern.

Pre-qualify eligibility for products and personalise services as well as accept more applications from a better understanding of an individual’s personal finances

Reduce underwriting time and accelerating decision making without increasing risk.

Upsell and cross-sell services to existing customers, or extend their credit limits responsibly using your understanding of their financial behaviour

Identify vulnerabilities and manage customers proactively to reduce delinquencies and debt.

An unrivalled comprehensive dataset of over 96 million transactions linked to a database of 1 million merchants.

API driven so the solution can be seamlessly integrated with your existing digital applications.

This form is for business enquiries only. If you are a consumer and have a transaction enquiry, you can view further information here. If you are a merchant and have feedback on Experian Look Who's Charging's data, please submit a merchant enquiry.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.